The Main Principles Of Stonewell Bookkeeping

Table of ContentsThe Facts About Stonewell Bookkeeping RevealedThe 30-Second Trick For Stonewell Bookkeeping3 Simple Techniques For Stonewell BookkeepingAll about Stonewell BookkeepingIndicators on Stonewell Bookkeeping You Need To Know

Instead of undergoing a filing closet of different records, invoices, and receipts, you can offer thorough records to your accountant. Consequently, you and your accounting professional can conserve time. As an included bonus offer, you may also be able to recognize potential tax write-offs. After using your accountancy to submit your taxes, the IRS may select to do an audit.

That funding can come in the type of owner's equity, grants, company car loans, and capitalists. Capitalists need to have a good idea of your company before spending. If you don't have accountancy documents, investors can not figure out the success or failure of your business. They need updated, precise details. And, that details requires to be readily easily accessible.

Get This Report about Stonewell Bookkeeping

This is not planned as legal suggestions; to find out more, please visit this site..

We responded to, "well, in order to recognize exactly how much you require to be paying, we require to know how much you're making. What is your internet revenue? "Well, I have $179,000 in my account, so I presume my net income (earnings less expenditures) is $18K".

Some Ideas on Stonewell Bookkeeping You Should Know

While it might be that they have $18K in the account (and also that could not be real), your balance in the financial institution does not always establish your revenue. If someone received a give or a lending, those funds are not thought about earnings. And they would certainly not infiltrate your earnings statement in identifying your profits.

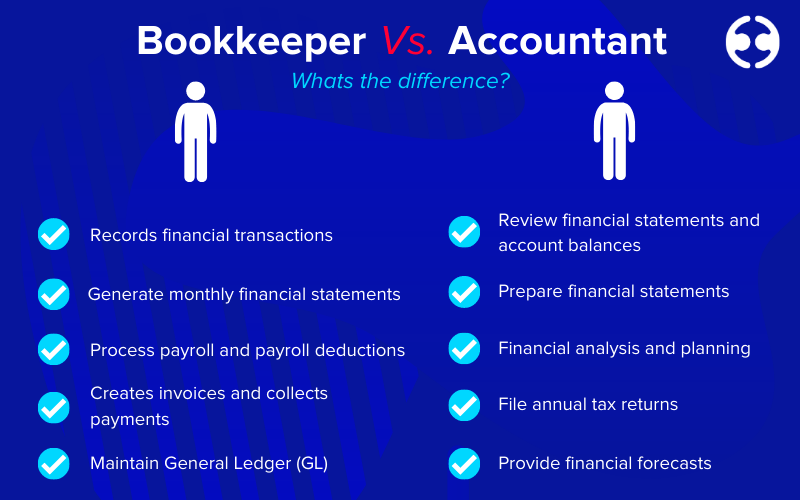

Lots of points that you assume are expenses and deductions remain in fact neither. A correct set of books, and an outsourced accountant that can correctly categorize those purchases, will assist you recognize what your organization is really making. Bookkeeping is the process of recording, classifying, and arranging a firm's economic transactions and tax obligation filings.

An effective business requires help from specialists. With practical goals and a qualified accountant, you can easily attend to challenges and keep those concerns at bay. We dedicate our energy to guaranteeing you have a solid economic structure for development.

A Biased View of Stonewell Bookkeeping

Precise bookkeeping is the backbone of good monetary administration in any organization. It helps track revenue and expenses, making sure every transaction is tape-recorded correctly. With good bookkeeping, services can make far better choices since clear monetary records supply beneficial data that can lead strategy and enhance profits. This information is vital for long-term planning and forecasting.

At the same time, strong accounting makes it less complicated to protect financing. Precise monetary statements develop count on with loan providers and financiers, boosting your opportunities of getting the resources you need to grow. To keep strong economic health, services should frequently integrate their accounts. This implies coordinating transactions with bank declarations to capture errors and stay clear of economic disparities.

A bookkeeper will cross financial institution declarations with interior documents at the very least when a month to discover errors or disparities. Called bank reconciliation, this procedure guarantees that the monetary documents of the company match those of the financial institution.

Money Circulation Declarations Tracks money movement in and out of the organization. These reports aid business proprietors recognize their monetary placement and make educated choices.

Things about Stonewell Bookkeeping

The best selection depends upon your budget plan and service requirements. Some local business proprietors like to take care of accounting themselves utilizing software application. While this is economical, it can be lengthy and prone to mistakes. Tools like copyright, Xero, and FreshBooks permit local business owner to automate bookkeeping tasks. These programs help with invoicing, bank reconciliation, basics and economic coverage.