The Greatest Guide To Stonewell Bookkeeping

Table of ContentsWhat Does Stonewell Bookkeeping Mean?Stonewell Bookkeeping - TruthsFacts About Stonewell Bookkeeping UncoveredThings about Stonewell BookkeepingWhat Does Stonewell Bookkeeping Do?

Rather than experiencing a filing cupboard of various files, billings, and receipts, you can provide thorough documents to your accounting professional. Consequently, you and your accountant can conserve time. As an added bonus, you may also be able to determine possible tax obligation write-offs. After using your accountancy to file your taxes, the internal revenue service may pick to carry out an audit.

That financing can come in the type of proprietor's equity, grants, organization lendings, and capitalists. Financiers require to have an excellent idea of your company before investing.

Everything about Stonewell Bookkeeping

This is not intended as lawful advice; for even more info, please go here..

We addressed, "well, in order to recognize just how much you require to be paying, we require to understand just how much you're making. What is your web income? "Well, I have $179,000 in my account, so I presume my web earnings (revenues less costs) is $18K".

Indicators on Stonewell Bookkeeping You Should Know

While it could be that they have $18K in the account (and also that may not hold true), your balance in the financial institution does not always establish your revenue. If someone obtained a grant or a car loan, those funds are ruled out earnings. And they would certainly not infiltrate your income declaration in determining your earnings.

Many points that you assume are costs and reductions remain in reality neither. A proper collection of publications, and an outsourced bookkeeper that can effectively classify those deals, will assist you identify what your organization is actually making. Bookkeeping is the process of recording, categorizing, and organizing a business's financial deals and tax obligation filings.

An effective organization requires help from professionals. With realistic goals and a qualified accountant, you can easily deal with difficulties and keep those worries at bay. We're right here to assist. Leichter Accountancy Solutions is a seasoned certified public accountant company with a passion for bookkeeping and commitment to our clients - best home based franchise (https://telegra.ph/Mastering-the-Art-of-Bookkeeping-Simplify-Your-Business-Finances-12-16). We commit our energy to guaranteeing you have a strong economic foundation for growth.

Stonewell Bookkeeping for Dummies

Accurate bookkeeping is the backbone of good monetary monitoring in any kind of organization. With excellent accounting, businesses can make better choices since clear financial documents use important data that can guide strategy and improve revenues.

Exact financial statements construct trust with lenders and financiers, boosting your opportunities of getting the resources you need to expand., businesses ought to consistently resolve their accounts.

They ensure on-time settlement of expenses and fast consumer settlement of billings. This boosts cash circulation and assists to prevent late penalties. A bookkeeper will cross financial institution declarations with internal records at the very least as soon as a month to locate mistakes or variances. Called financial institution settlement, this process guarantees that the economic documents of the business match those of the financial institution.

They keep an eye on present pay-roll data, deduct tax obligations, and number pay scales. view it Bookkeepers create standard economic records, consisting of: Revenue and Loss Declarations Shows revenue, expenditures, and net earnings. Annual report Lists properties, obligations, and equity. Capital Declarations Tracks money movement in and out of business (https://writeablog.net/hirestonewell/rqhr1mxsuw). These reports help local business owner understand their economic position and make notified choices.

The Main Principles Of Stonewell Bookkeeping

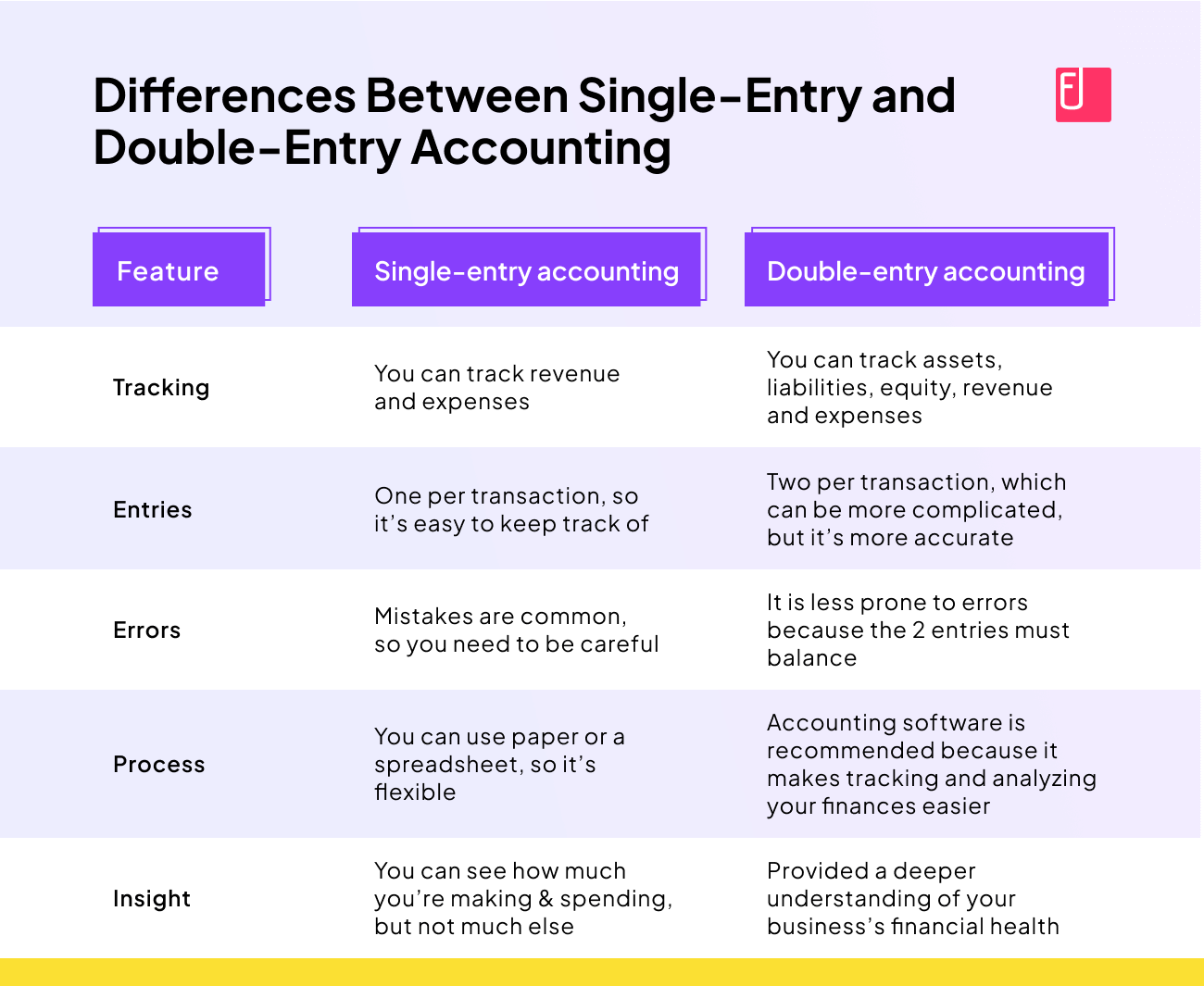

While this is cost-efficient, it can be time-consuming and vulnerable to mistakes. Tools like copyright, Xero, and FreshBooks enable organization owners to automate accounting jobs. These programs help with invoicing, financial institution reconciliation, and financial coverage.